Fascination About San Diego Home Insurance

Fascination About San Diego Home Insurance

Blog Article

Protect Your Home and Possessions With Comprehensive Home Insurance Policy Insurance Coverage

Recognizing Home Insurance Policy Insurance Coverage

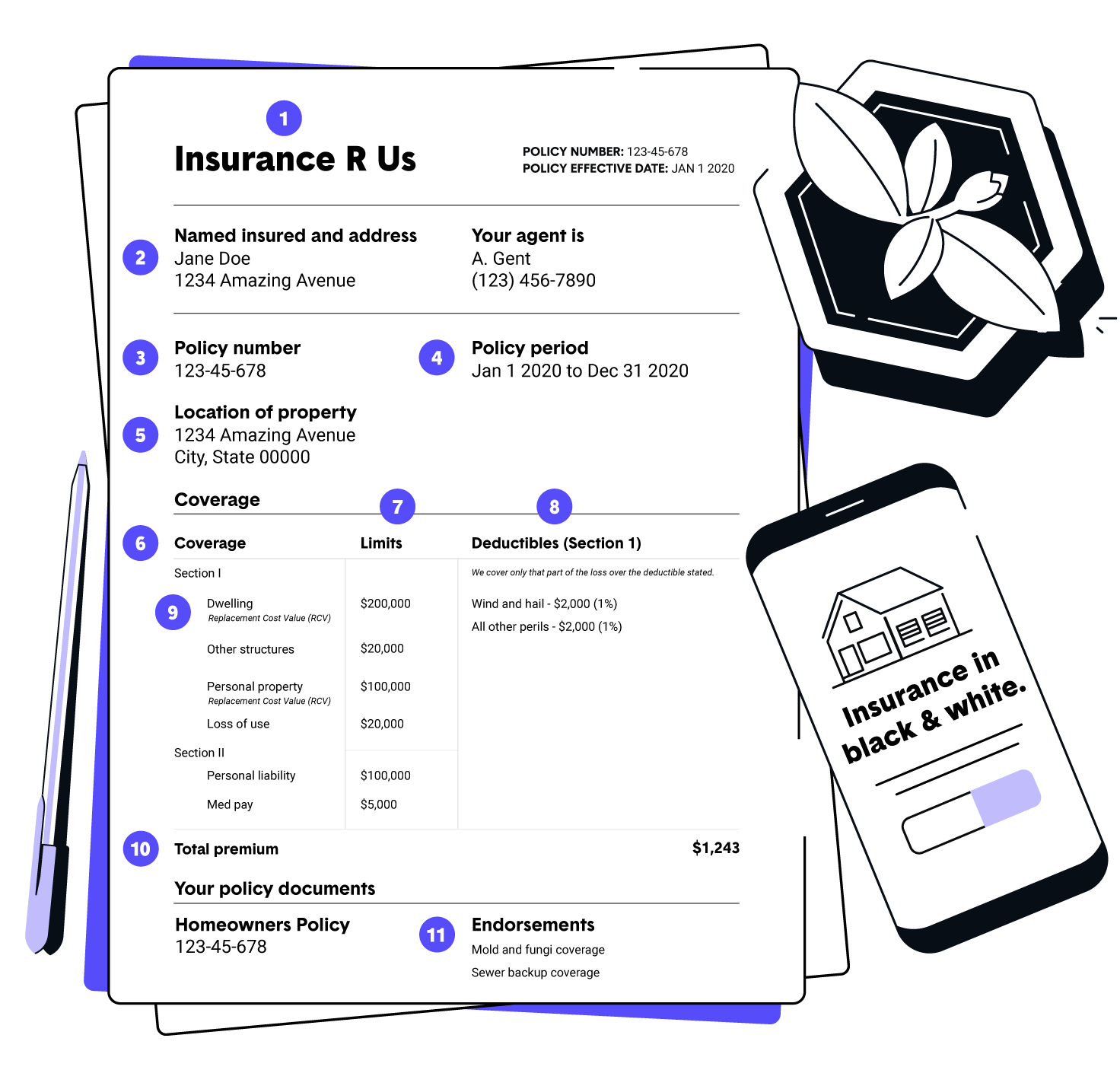

Recognizing Home Insurance coverage Coverage is vital for home owners to protect their property and assets in situation of unanticipated events. Home insurance coverage commonly covers damages to the physical framework of your home, individual possessions, responsibility security, and additional living expenditures in the occasion of a covered loss - San Diego Home Insurance. It is crucial for home owners to realize the specifics of their policy, including what is covered and omitted, policy limits, deductibles, and any kind of added endorsements or cyclists that may be needed based upon their individual conditions

One key aspect of comprehending home insurance policy protection is knowing the difference between real money worth (ACV) and substitute expense protection. Home owners should additionally be aware of any type of coverage limitations, such as for high-value products like fashion jewelry or art work, and think about buying extra protection if needed.

Advantages of Comprehensive Policies

When checking out home insurance policy coverage, homeowners can gain a much deeper recognition for the security and tranquility of mind that comes with extensive plans. Comprehensive home insurance plans provide a vast range of benefits that go past basic protection.

Additionally, comprehensive plans typically consist of insurance coverage for obligation, supplying protection in instance somebody is wounded on the property and holds the home owner liable. This liability protection can aid cover medical costs and legal expenses, offering additional tranquility of mind for house owners. Additionally, extensive policies may likewise supply additional living costs insurance coverage, which can aid spend for short-term real estate and various other essential prices if the home becomes unliveable as a result of a protected event. Generally, the detailed nature of these policies offers house owners with robust defense and economic safety in various scenarios, making them a useful investment for protecting one's home and assets.

Customizing Coverage to Your Needs

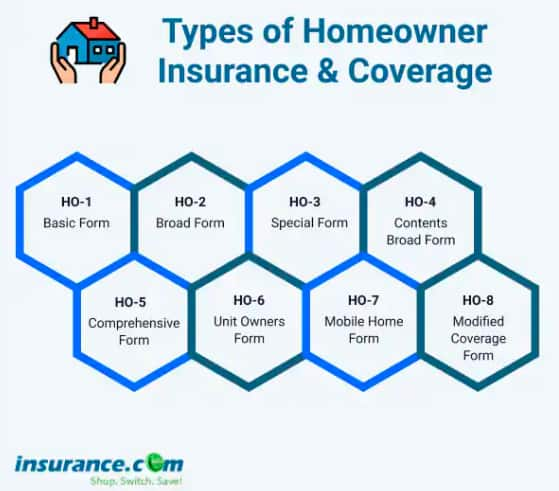

Customizing your home insurance coverage to align with your details needs and circumstances makes certain a personalized and efficient guarding approach for your residential property and assets. Personalizing your coverage allows you to address the one-of-a-kind elements of your home and ownerships, offering a more thorough shield versus possible threats. Eventually, customizing your home insurance policy coverage supplies peace of mind recognizing that your assets are secured according to your distinct situation.

Safeguarding High-Value Possessions

To appropriately safeguard high-value possessions within your home, it is vital to examine their worth and consider specialized protection alternatives that provide to their special worth and importance. High-value possessions such as fine art, jewelry, vintages, and antiques might go beyond the coverage limits of a typical home insurance coverage. As a result, it is crucial to collaborate with your insurance policy provider to ensure these things are properly safeguarded.

One method to protect high-value assets is by arranging a separate policy or endorsement click this particularly for these products. This specialized coverage can provide higher coverage restrictions and might additionally consist of extra protections such as insurance coverage for unintentional damages or strange loss.

In addition, before getting insurance coverage for high-value possessions, it is advisable to have these things properly assessed to establish their current market price. This assessment documents can assist enhance the claims procedure in case of a loss and make certain that you get the proper compensation to replace or fix your important properties. By taking these positive actions, you can enjoy satisfaction knowing that your high-value properties are well-protected versus unpredicted scenarios.

Insurance Claims Refine and Plan Monitoring

Verdict

In final thought, it is essential to ensure your home and assets are sufficiently protected with extensive home insurance policy coverage. It is essential to prioritize the protection of your home and assets via thorough insurance coverage.

One trick facet of understanding home insurance protection is understanding the difference between real cash value (ACV) and replacement expense coverage. Home owners need to additionally be conscious of any type of coverage limits, such as for high-value items like precious jewelry or artwork, and consider purchasing added protection if required.When discovering home insurance policy coverage, homeowners can obtain a deeper appreciation for the defense and peace of mind that comes with thorough policies. High-value assets such as fine art, precious jewelry, antiques, and collectibles might exceed the protection restrictions of a basic home insurance coverage policy.In verdict, it is necessary to ensure your home and properties are appropriately safeguarded see page with thorough home insurance protection.

Report this page